Legislative Session Report Week 6

February 19, 2021

State News and Updates

GENERAL ASSEMBLY MEETS FOR THREE DAYS; GOVERNOR ANNOUNCES VACCINATION SITES

The Georgia General Assembly met for three days this week, bringing us to the 19th legislative day. Earlier this week the Governor signed the Amended FY21 Budget which included no new agency cuts, furloughs, layoffs or new taxes. The House has continued work on the FY22 budget and other legislation continues to be introduced, heard by committees, and voted on. Both the Senate and House Agriculture and Consumer Affairs Committees met this week taking up mostly legislation related to consumer protection issues. Lawmakers will return to the Capitol on Monday, which will mark the halfway point of this year’s session. To keep up with legislation affecting Georgia agriculture please see the Action This Week and Bills of Interest sections below.

Additionally, on Thursday, Governor Kemp announced four new COVID-19 vaccination sites across the state to open on February 22. These sites will be able to vaccinate 1,100 people per day, per site. Individuals in the Department of Public Health’s 1A+ phase are currently eligible, which includes healthcare workers, residents and staff of long-term care facilities, adults 65+, and law enforcement, firefighters, and first responders. The sites will be open 8am-5pm, Monday through Friday at the following locations:

- Delta Air Museum, 1220 Woolman Place SW, Hapeville, GA 30354

- Albany Georgia Forestry Site, 2910 Newton Road, Albany, GA 31701

- Habersham County Fairgrounds, 4235 Toccoa Highway Clarkesville, GA 30523

- Macon Farmers Market, 2055 Eisenhower Parkway, Macon, GA 31206

GOVERNOR BRIAN KEMP SIGNS AMENDED FY2021 BUDGET

On Monday afternoon, Governor Brian Kemp - joined by Lieutenant Governor Geoff Duncan, Speaker of the House David Ralston, and other legislative leaders - signed the $26.5 billion amended FY21 (AFY21) budget. The AFY21 budget required no additional agency cuts, no furloughs, no layoffs, and no new taxes for the state's residents. It prioritized funding for essential workers including those in healthcare and education, and it also allocated $20 million to expand rural broadband access.

With the AFY21 budget signed, lawmakers continued work on the FY22 budget this week.

Senate Appropriations Chairman Blake Tillery and House Appropriations Chairman Terry England preside over budget hearings last month

MODERNIZING AD VALOREM EXEMPTION FOR AGRICULTURE

A few years ago, Georgia Farm Bureau (GFB) worked closely with Rep. Sam Watson (R-Moultrie) to pass legislation modernizing the definition of a “farm entity” within the CUVA program to reflect the way many farms are currently structured. While originally only family-owned property was allowed in the program, his change acknowledged the trend of consolidated farm ownership prevalent in today’s industry, stating that the creation of a farm entity made up of two people who individually qualify is also eligible.

This problem has surfaced again, this time relating to the ad valorem tax exemption of farm equipment and products. Rep. Watson is pursuing the same solution for this exemption to reflect the industry’s shift to consolidated farm structures. While only a few instances have emerged targeting co-owned farms with significant tax bills, this may become more problematic in the future should FSA continue forward with the reconsolidation of farm numbers. Unlike the solution reached with CUVA, the change to the ad valorem exemption requires approval by voters in a referendum. House Bill 498 provides the ad valorem tax exemption for farm entities made up of individually qualified owners and directs a statewide referendum process in November 2022 to enact it.

Representative Sam Watson (R-Moultrie) on the House floor earlier this week.

DEBATE OVER DAYLIGHT SAVINGS TIME HITS CAPITOL

Two opposing bills have been introduced at the State Capitol this session regarding Georgia's stance on daylight savings time, stirring up concern from farmers statewide.

House Bill 44, introduced by Rep. Wes Cantrell of Woodstock, would require the state to observe daylight savings time as the official model year round. However, this would only become effective if Congress authorizes states to observe daylight savings time year round.

On the Senate side, Sen. Ben Watson of Savannah has introduced Senate Bill 100. This bill would require the state to observe standard time year round effective immediately. If Congress authorizes states to observe daylight savings time year round, the state would then observe daylight savings time.

When clocks "fall back" in November, they switch from daylight to standard time, allowing for brighter mornings and darker evenings. When clocks "spring forward" in March, they go from standard to daylight, allowing for longer periods of daylight in the evenings. A number of arguments can be made for both standard and daylight time, but many in Georgia's agricultural, natural resources, and recreational industries prefer daylight for that very reason - longer periods of daylight in the evening allow for more time outside on the farm, in the field, or on the golf course, positively affecting the mental and physical wellbeing of Georgians as well as boosting local economies.

Neither Georgia Farm Bureau or the American Farm Bureau Federation have current policy surrounding daylight savings time, but we will continue to monitor these bills as they make their way through the legislature. If you are interested in contacting your legislators regarding these bills, you may do so by clicking here.

GEORGIA A TOP-10 EXPORTING STATE FOR THE FIRST TIME

Despite the challenges presented by the ongoing Covid-19 pandemic, Governor Kemp announced earlier this week that Georgia was ranked as a top-10 exporting state in 2020, an achievement the state has never seen before. Georgia exported $38.8 billion of goods last year, reaching 215 different countries and territories worldwide.

Georgia's poultry industry saw a substantial boost as a result of the Phase One trade agreement with China, signed in January of 2020. Georgia's exports to China increased by 45% last year. As a whole, Georgia's agricultural industry delivered $4.25 billion in global exports, maintaining its export totals from 2019.

To learn more, view Georgia's 2020 Global Trade Summary here.

GEORGIA STATE HOUSE DISTRICT 90 SPECIAL ELECTION

A special election was held this week for Georgia State House District 90, previously held by Pam Stephenson (D-Lithonia). Stephenson resigned from her position and candidacy in September.

There were six candidates, all democrats, vying for the seat. As no candidate received more than 50% of the roughly 3,000 votes cast, the top two contenders - Stan Watson and Angela Moore - will move on to a runoff election on March 9.

House District 90 is based in DeKalb County. To check your district and voter registration status, click here.

ACTION THIS WEEK

HB 90:

Reps. Williamson, Burns, Dickey, Hatchett, Morris, and Watson

HB 90 seeks to address an issue that the existing 1939 statute does not appropriately cover modern forestry practices with in regards to mill purchases of cut timber and the chain of liability that follows such transactions. The legislation is supported by both the Georgia Bankers Association and the Georgia Forestry Association.

House Passed/Adopted by Substitute on 2/17/2021.

HB 150:

Reps. Williamson, Hatchett, Kelley, Frazier, Parsons, and Smith

In a concerning trend, some state and local authorities in the U.S. have adopted measures banning the connection of certain fuels (propane and natural gas) in new construction in an effort to reach their “carbon free” goals. HB 150 would prohibit government entities in Georgia from banning the connection of any utility service based on the type or source of fuel. GFB supports this bill, as many agricultural producers rely on these resources.

House Energy, Utilities, and Telecommunications Committee Favorably Reported by Substitute on 2/17/2021.

HB 282:

Reps. Meeks, England, Hatchett, Watson, and Dickey

This bill provides clarity to the ad valorem taxation of qualified timberland property by defining parameters for “contiguous” property, specifying how the appraised value of timberland property is calculated, and clarifies the required documentation landowners must submit to the Commissioner of Revenue for certification.

House Passed/Adopted by Committee Substitute on 2/17/2021.

HB 336:

Reps. Corbett, Dickey, Pirkle, Jasperse, and Watson

Following two years of extensive legislation establishing Georgia's new hemp industry, HB 336 is a cleanup bill seeking to align Georgia's hemp laws to match federal standards.

Assigned to House Agriculture and Consumer Affairs Committee on 2/9/2021.

HB 482:

Reps. Lim and Holcomb

This bill would provide a preferential tax rate program that seeks to promote urban agriculture as well as provide for urban agricultural incentive zones that would be located in areas with a 15% or greater poverty rate. The program includes restrictions for properties that enter a contract such as being at least .10 acres but not more than 5 acres and for an initial term of at least 5 years. This bill is the enabling legislation for HR 164 that would put this change on the ballot in 2022 as a constitutional amendment.

Assigned to House Ways and Means Committee on 2/17/2021.

HB 496:

Reps. Burchett, Burns, Rhodes, Ridley, and Williams

This bill seeks to create a $1,000 Annual Forest Product Permit, issuable by the Department of Transportation, allowing vehicles hauling timber up to a gross weight of 95,000, up to 10 feet wide, and no more than 100 feet long.

Assigned to House Transportation Committee on 2/18/2021.

HB 498:

Reps. Watson, Dickey, LaHood, England, and Pirkle

Tax programs and business models have increased the prevalence of family farm mergers. This bill modernizes the ad valorem tax exemption of farm equipment and products to these merged entities, so long as they would qualify for the exemption individually.

Assigned to House Ways and Means Committee on 2/18/2021.

HB 500:

Reps. Burchett, Blackmon, Dickey, Rhodes, and Watson

The Georgia Agribusiness and Rural Jobs Act, established in 2017, provides a system of non-traditional loans for rural businesses to encourage economic growth and jobs. This legislation would provide the second round of funding, in the amount of $100 million, to replenish the program.

Assigned to House Ways and Means Committee on 2/18/2021.

HB 504:

Reps. Williamson, Reeves, Burns, Knight, Blackmon, and Lott

Similar to HB 500, this legislation provides a second round of funding for the Georgia Agribusiness and Rural Jobs Act in the amount of $100 million. However, the bill goes on to create a new NAICS code and tax program for medical equipment and supplies manufacturers. Additionally, this bill goes on to address other tax credit programs dealing with high-impact aerospace defense projects, Georgia ports, and railroads.

Assigned to House Ways and Means Committee on 2/18/2021.

HR 164:

Reps. Lim and Holcomb

HR 164 would allow for a constitutional amendment to be on the ballot in 2022 should HB 482 pass. See above for additional information on HB 482.

Assigned to House Ways and Means Committee on 2/17/2021.

SB 100:

Sens. Watson, Dugan, Kennedy, Miller, Au, and Burke

This bill would require Georgia to observe Standard Time year round until Congress authorizes states to observe Daylight Savings Time, at which point Georgia would observe Daylight Savings Time year round.

Senate Government Oversight Committee Favorably Reported on 2/17/2021.

SB 119:

Sens. Harper, Goodman, Burke, Mullis, Anderson, and Walker

Under Senate Bill 119, you would not have to obtain a burn permit to burn leaf piles, yard debris, or hand-piled natural vegetation, given that you meet guidelines regarding time, location, and others.

Senate Natural Resources and Environment Committee Adopted by Substitute on 2/18/2021.

SB 148:

Sens. Hufstetler, Miller, Butler, Dugan, Parent, and Mullis

Senate Bill 148 calls for the systematic study of the state's revenue structure through the creation of the Special Council on Tax Reform and Fairness for Georgians and the Special Joint Committee on Georgia Revenue Structure. The committee would report its findings and make recommendations to the Speaker of the House and the Lieutenant Governor by January 10, 2022.

Senate Finance Committee Favorably Reported by Substitute on 2/18/2021.

SB 195:

Sen. Mullis

In another minute clarification to Georgia’s new hemp industry, this legislation states that the drying and curing of hemp plants does not qualify as “processing.”

Assigned to Senate Agriculture and Consumer Affairs Committee on 2/17/2021.

BILLS OF INTEREST

HB 44:

Reps. Cantrell, Greene, Barr, Werkheiser, Gambill, Williams

This bill would require Georgia to observe Daylight Savings Time year round.

House State Planning and Community Affairs Committee favorably reported on 1/29/2021.

HB 139:

Reps. Mainor, Dukes, McClain, Mallow, Thomas

This bill would prohibit trains from blocking any traffic crossing for longer than 15 minutes (with exceptions for safety reasons), and also require signage at crossings providing a telephone number to report such instances.

Assigned to House Transportation Committee on 1/28/2021.

HB 265:

Reps. Knight, Williamson, and Blackmon

House Bill 265 aims to clean up the state's revenue code, a large portion of the bill relating to tax-relief measures stemming from federal Covid-19 relief legislation. Included in the bill is a measure which would make certain Payroll Protection Program (PPP) loans tax exempt. Under SB 265, businesses eligible for PPP loan forgiveness would not be required to pay state taxes on the loans, even though they count as income. The measure also lets those business owners claim tax deductions on the loans.

Passed the House on 2/9/2021. Assigned to Senate Finance Committee on 2/10/2021.

HB 290:

Reps. Setzler, Newton, Hatchett, Rich, Jackson, and Bentley

House Bill 290, or the "Right to Visit" Bill, would require Georgia's hospitals and nursing home facilities to allow patients to visit with family members for a minimum of two hours per day - even during a public health emergency such as the Covid-19 pandemic - following proper safety and health protocols including as negative testing.

Assigned to House Human Relations and Aging Committee on 2/4/2021.

SB 30:

Sens. Beach, Harbison

Senate Bill 30 would provide for pari-mutuel horse racing in the state at a limited number of licensed equestrian centers, create the Georgia Horse Racing Commission, and provide for the comprehensive regulation of pari-mutuel horse racing and related activities.

Assigned to House Regulated Industries and Utilities Committee on 1/28/2021.

SB 65:

Sens. Gooch, Miller, Cowsert, Tillery, Harper, and Hatchett

In a continued effort to expand broadband access to rural and un-served communities, this legislation allows the Public Service Commission and Department of Community Affairs to utilize a portion of the Universal Access Fund for such services.

Assigned to Senate Regulated Industries and Utilities Committee on 2/2/2021.

SB 118:

Sens. Harper, Burke, Tillery, Goodman, Anderson, and Kennedy

SB 118 would increase truck weights for 6-axle timber haulers up to 100,000 lbs.

Assigned to Senate Transportation Committee on 2/10/2021.

We have received a number of questions regarding election laws within the state over the past few months, and an assortment of bills regarding the subject have been filed in both the House and the Senate during the 2021 legislative session. Below you will find a list of many of the bills of interest surrounding elections and elected officials both in Georgia and Washington, D.C.

ELECTION AND POLICY BILLS OF INTEREST

HB 59:

Reps. Cantrell, Clark, Rich, and Evans

House Bill 59 would provide special absentee ballots for, as well as authorize the use of instant runoff voting for, those overseas citizens and military personnel who cannot vote in person. Rather than wait until after a runoff election is called to submit a ballot, voters would have the opportunity to submit a special runoff ballot with their general election ballot, to be opened and counted only if a runoff election is required.

Assigned to the Special Committee on Election Integrity on 1/12/2021.

HB 62:

Reps. Gullett, Powell, Momtahan, Williams, Gambill, and Singleton

This bill would ban third-party organizations from funding local election operations.

Assigned to the Special Committee on Election Integrity on 1/13/2021.

HB 270:

Reps. Fleming, Jones, DeLoach, Williams, Powell, and Blackmon

House Bill 270 would require all absentee by mail ballot applications to be received by the board of registrars or absentee ballot clerk by no later than 5:00 pm on the second Friday before the primary, election, or runoff and also requires that election officials get absentee ballots in the mail within three business days of receipt. Additionally, no ballots may be issued or mailed following the close of business on the Wednesday prior to the primary, election, or runoff.

Special Committee on Election Integrity Favorably Reported by Substitute on 2/10/2021.

HB 461:

Reps. Fleming, Jones, Rich, Williams, and DeLoach

This bill would allow for all returned absentee ballots to be securely opened and counted ahead of Election Day.

Assigned to the Special Committee on Election Integrity on 2/16/2021.

SB 29:

Sen. Anavitarte

This bill would require those wishing to vote in a Georgia election by absentee ballot to include a photocopy of their driver's license, voter ID card, U.S. passport, government employee ID, military ID card, or tribal identification card both when applying for an absentee ballot application and when returning it. Members of the military and overseas voters would be exempt from this requirement.

Referred to Senate Ethics Committee on 1/28/2021.

SB 67:

Sens. Walker, Miller, Mullis, Kennedy, Gooch, and Anavitarte

SB 67 would require Georgia's voters to provide a copy of a valid driver's license, voter ID card, or state ID number when requesting an absentee ballot. It would also allow the Secretary of State's office to establish a web portal in which a voter may submit a request for an absentee ballot by providing proper identification, following which the Secretary of State's office would forward the information to the voter's county of residence for issuance of an absentee ballot.

Senate Ethics Committee Favorably Reported by Substitute on 2/18/2021.

SB 68:

Sens. Mullis, Miller, Gooch, Walker, Albers, and Hickman

This bill would eliminate absentee ballot drop boxes and require all absentee ballots to be either mailed or hand-delivered to the appropriate county election registrar or clerk.

Assigned to Senate Ethics Committee on 2/2/2021.

SB 69:

Sens. Mullis, Miller, Gooch, Walker, Hickman, and McNeill

Senate Bill 69 would prohibit automatic voter registration when driver's licenses are attained; instead, residents would have to explicitly indicate the desire to register to vote and subsequently sign a voter registration application.

Assigned to Senate Ethics Committee on 2/2/2021.

SB 70:

Sens. Mullis, Miller, Gooch, Walker, Albers, and HIckman

This bill would prohibit new residents of Georgia from voting in runoff elections in the same election cycle.

Assigned to Senate Ethics Committee on 2/2/2021.

SB 71:

Sens. Mullis, Miller, Hickman, McNeill, Beach, and Burns

Senate Bill 71 would end "no excuse" absentee voting and limit absentee voting to residents over the age of 75, those with disabilities, or those required to be absent from their voting precinct.

Assigned to Senate Ethics Committee on 2/2/2021.

SB 73:

Sens. Mullis, Miller, Gooch, Walker, Albers, and Hickman

SB 73 would prohibit all persons and organizations other than the Secretary of State, an election superintendent, a board of registrars, or a candidate or candidate's campaign committee to distribute absentee ballot request forms.

Assigned to Senate Ethics Committee on 2/2/2021.

SB 89:

Sens. Miller, Albers, Gooch, Kennedy, Anavitarte, and Brass

Senate Bill 89 would create within the Secretary of State's office a "Chief Elections Assistance" officer to work under the supervision of the director of the Elections Division. The Chief Elections Assistance officer shall be appointed by the State Election Board. The officer would be responsible for overseeing and training county election superintendents, establishing a list of third-party vendors to perform routine audits and evaluations of election management practices, and provide support to those lowest-performing election superintendents in need of assistance.

Senate Ethics Committee Favorably Reported by Substitute on 2/18/2021.

SB 93:

Sens. Robertson, Anderson, Mullis, Harbin, Thompson, and Anavitarte

This bill would allow for the usage of mobile voting precincts only when existing polling places are deemed unsafe for human occupation or has suffered loss of water and/or electricity. Any other usage of mobile voting precincts would be banned.

Assigned to Senate Ethics Committee on 2/8/2021.

SB 141:

Sens. Anavitarte, McNeill, Thompson, Robertson, Hickman, and Gooch

SB 141 would require immediate counting and tabulation of ballots following the closure of polls until counting and tabulation is completed.

Assigned to Senate Ethics Committee on 2/10/2021.

SR 83:

Sens. Miller, Gooch, Walker, Burke, and Albers

This resolution proposes an amendment to the Constitution that would allow members of the House of Representatives to serve four-year terms of office and the Senate to serve six-year terms.

Assigned to Senate Government Oversight Committee on 2/10/2021.

Federal News and Updates

2021 AEWR REVEALED

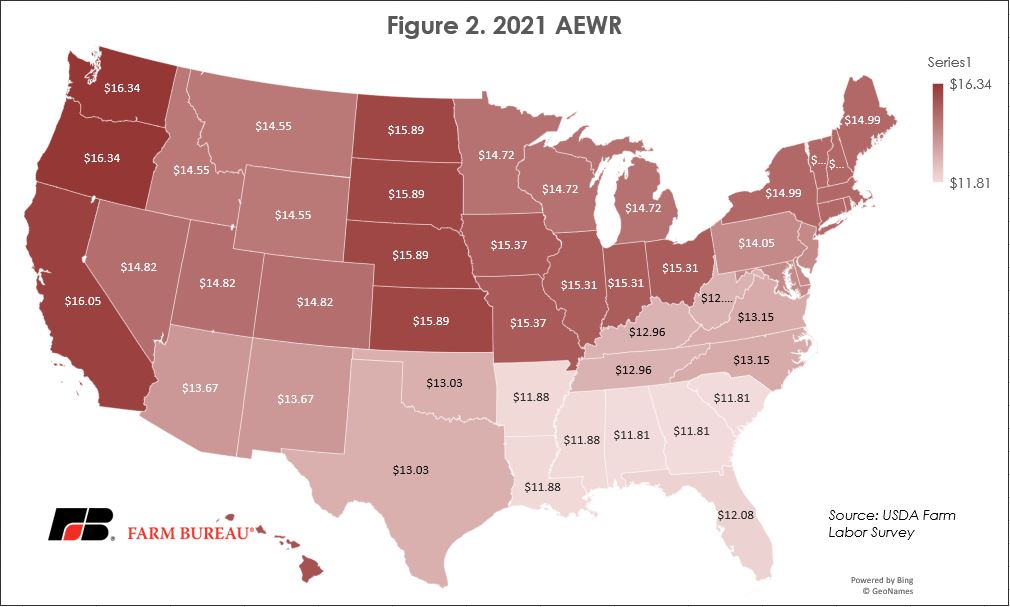

With the release of USDA’s Farm Labor Survey (FLS) on February 11, farmers that utilize the H-2A program finally know the minimum wage they must pay their H-2A workers in 2021. Usually this wage rate, known as the Adverse Effect Wage Rate (AEWR), is known when the Farm Labor Survey is released in November, but changes in policy that were proposed and then struck down in the courts over the last four months delayed the Farm Labor Survey’s release, which in turn held up the AEWR announcement. The FLS reveals an average increase of $0.63 per hour, or 4.5%, from 2020 to 2021, though there are considerable regional differences.

There are eighteen regions that makeup the FLS. The Southeast region, including Georgia, saw one of the lowest increases in the AEWR from 2020 to 2021 with only a 0.9% increase. Only the Delta region (Arkansas, Louisiana, and Mississippi) had a lower increase at 0.4%. The national average gross wage rate for field and livestock workers increased by 2.6% for the 12-month period ending in December of 2020. The Southeast AEWR rate now sits at $11.81.

For more information on the Farm Labor Survey and the Adverse Effect Wage Rate announcement, click here.

2021 Adverse Effect Wage Rates by state. Rates are determined on a regional basis.

CFAP 2.1 APPLICATIONS DUE FEBRUARY 26

On January 15, USDA announced additional assistance through the Coronavirus Food Assistance Program. Since that announcement, the Biden administration has halted processing and payments pending review. Local FSA offices will continue to accept applications while the administration evaluates the program. Should it be reinstated, this new assistance will include expanded eligibility for certain commodities and producers established in the recently passed relief package, as well as updated payments for producers who were eligible under previous iterations of the program. Producers have from January 19 through February 26 to submit new applications or modify existing applications if they have participated in the program already. For more information, click here.

REP. AUSTIN SCOTT BILL AIMS TO SIGNIFICANTLY INCREASE CCC'S BORROWING LIMIT

Earlier this week, Georgia Representative Austin Scott (R) introduced H.R. 843, which would more than double the Commodity Credit Corporation’s (CCC) borrowing limit. Currently set at $30 billion, the cap has been in place since 1987. Scott’s proposal would bring the limit to a total of $68 billion, accounting for the inflation-adjusted value of the current $30 billion cap, put in place over 30 years ago.

The CCC has provided much-needed funding to farmers and ranchers since its inception. The majority of payments for many farm bill programs, as well as supplemental assistance for nutrition programs, stems from the CCC. Additionally, recent Coronavirus Food Assistance Program (CFAP), Market Facilitation Program (MFP), and disaster payments have stemmed from the CCC funding umbrella. In September, Congress had to replenish the CCC as funds ran perilously low, sparking the need for a higher borrowing limit.

To learn more about Scott’s bipartisan bill, co-sponsored by fellow members of the Georgia delegation and supported by the American Farm Bureau Federation, click here.

CFAP 2.1 APPLICATIONS DUE FEBRUARY 26

On January 15, USDA announced additional assistance through the Coronavirus Food Assistance Program. Since that announcement, the Biden administration has halted processing and payments pending review. Local FSA offices will continue to accept applications while the administration evaluates the program. Should it be reinstated, this new assistance will include expanded eligibility for certain commodities and producers established in the recently passed relief package, as well as updated payments for producers who were eligible under previous iterations of the program. Producers have from January 19 through February 26 to submit new applications or modify existing applications if they have participated in the program already. For more information, click here.

MARCH 15 LAST DAY TO COMPLETE ENROLLMENT FOR 2021 ARC AND PLC PROGRAMS

Agricultural producers who have not yet enrolled in the Agriculture Risk Coverage (ARC) or Price Loss Coverage (PLC) programs for 2021 must do so by March 15. Producers who have not yet signed a 2021 enrollment contract or who want to make an election change should contact their local USDA Farm Service Agency (FSA) office to make an appointment. Program enrollment for 2021 is required in order to participate in the programs, but elections for the 2021 crop year are optional and otherwise remain the same as elections made for 2020.

Producers who do not complete enrollment by close of business local time on Monday, March 15 will not be enrolled in ARC or PLC for the 2021 crop year and will be ineligible to receive a payment should one trigger for an eligible crop.

ARC and PLC contracts can be emailed, faxed or physically signed and mailed back to FSA. For more information on ARC and PLC including web-based decision tools, visit farmers.gov/arc-plc.

NOT A MEMBER OF GEORGIA FARM BUREAU? JOIN TODAY!

The Georgia Farm Bureau Federation has a membership of almost 250,000 and serves as state's the largest general farm organization. Our goal is to provide leadership and assistance to the agricultural sector, to promote farm products, to aid in ag-related procurement, to be a spokesman for the farmer in the legislative arena, to be a leader in the development and expansion of farm markets, and to strive for more agricultural research and educational funds and facilities.

With members in all 159 Georgia counties, Georgia Farm Bureau is dedicated to promoting and improving agriculture in our counties, state and nation and in continually improving and expanding our service-to-member programs which serve to enhance the quality of life for all Georgians.

Membership in Georgia Farm Bureau is open to everyone. You don't need to be a farmer or have insurance with us to join Farm Bureau!

If you would like to become a member of Georgia Farm Bureau, you can start your membership online right now! We have a simple application process, and you can be our newest member in just a couple of minutes. Click the button below or use our County Office Locator to find the office nearest you.

Georgia Farm Bureau Public Policy Department Staff

Jeffrey Harvey, Director

Joe McManus, Assistant Director

Alex Bradford, State Affairs Coordinator

Raynor Churchwell, Agricultural Programs Specialist

Tripp Cofield, National Policy Counsel

Katie Duvall, Advocacy and Policy Development Coordinator

Renee Jones, Office Coordinator

Jake Matthews, Governmental Affairs Specialist

Jeremy Taylor, Agricultural Programs Specialist

** Photos courtesy of Georgia House and Senate photography gallery.