GFB News Magazine

Economic help for farmers comes in pieces

by Jay Stone & Jennifer Whittaker

Posted on March 10, 2025 7:52 AM

Even before Hurricanes Debby and Helene struck last year, many Georgia row crop farmers were facing a financial crisis. For most, what they made on their 2023 crops didn’t cover their production costs. The situation repeated itself in 2024, but with higher losses due to excess rain and drought that required many farmers to replant crops to get a stand.

American Farm Bureau economists say having to rely on safety net programs from the 2018 farm bill with outdated reference prices has left farmers nationwide exposed to severe financial pressure. Higher labor costs, interest expenses and taxes are the highest of production expenses.

Last September, USDA forecast that net farm income, a key measure of profitability, was expected to decline nationwide by $6.5 billion (4%) from 2023. This came after a 19% drop in farm income from 2022 to 2023. Many farmers had to seek additional loans last year to harvest their crops.

Congress failed to pass a new farm bill last year but in December passed the American Relief Act of 2025, which was signed into law on Dec. 21, 2024. This act extends the 2018 farm bill through September 2025 and funds disaster relief and economic assistance to farmers.

The U.S. House passed the bill by a 366-34 vote and the Senate by a 85-11 vote. Ten of Georgia’s 14 representatives and both of Georgia’s senators voted for it.

While the extension gives Congress until Sept. 30 to pass a new farm bill, it did not fund numerous programs without baseline funding. Unfunded programs range from the Feral Swine Eradication & Control Pilot Program to Emergency Citrus Disease Research.

Economic Aid

Of the American Relief Act’s $31 billion in direct payments for farmers and ranchers, $10 billion is specifically for economic aid in response to the dire financial situation farmers are facing. The bill states the $10 billion must be distributed within 90 days of enactment through a one-time payment to producers of eligible commodities in the 2024 crop year. Eligible commodities are those covered by Title I of the farm bill.

On March 3, while speaking at the Commodity Classic in Denver, U.S. Secretary of Agriculture Brooke Rollins announced the USDA’s plan to distribute the economic assistance included in the American Relief Act. Rollins said the funds would be distributed through the Emergency Commodity Assistance Program (E-CAP) and that the USDA is on track to start taking applications by March 20.

“I have asked my team to think creatively about how to develop a streamlined application process. In cases where we have information already on file, a pre-filled application will be sent to you. The Farm Service Agency will use the 2024 acreage reporting data you previously filed to initiate the application process,” Rollins said. “There will also be an opportunity for you to provide this information if you missed the window. You will be asked to review the information, sign and return the completed application back to your local FSA service center. We are also developing tools to provide fair and transparent standards for calculating payments.”

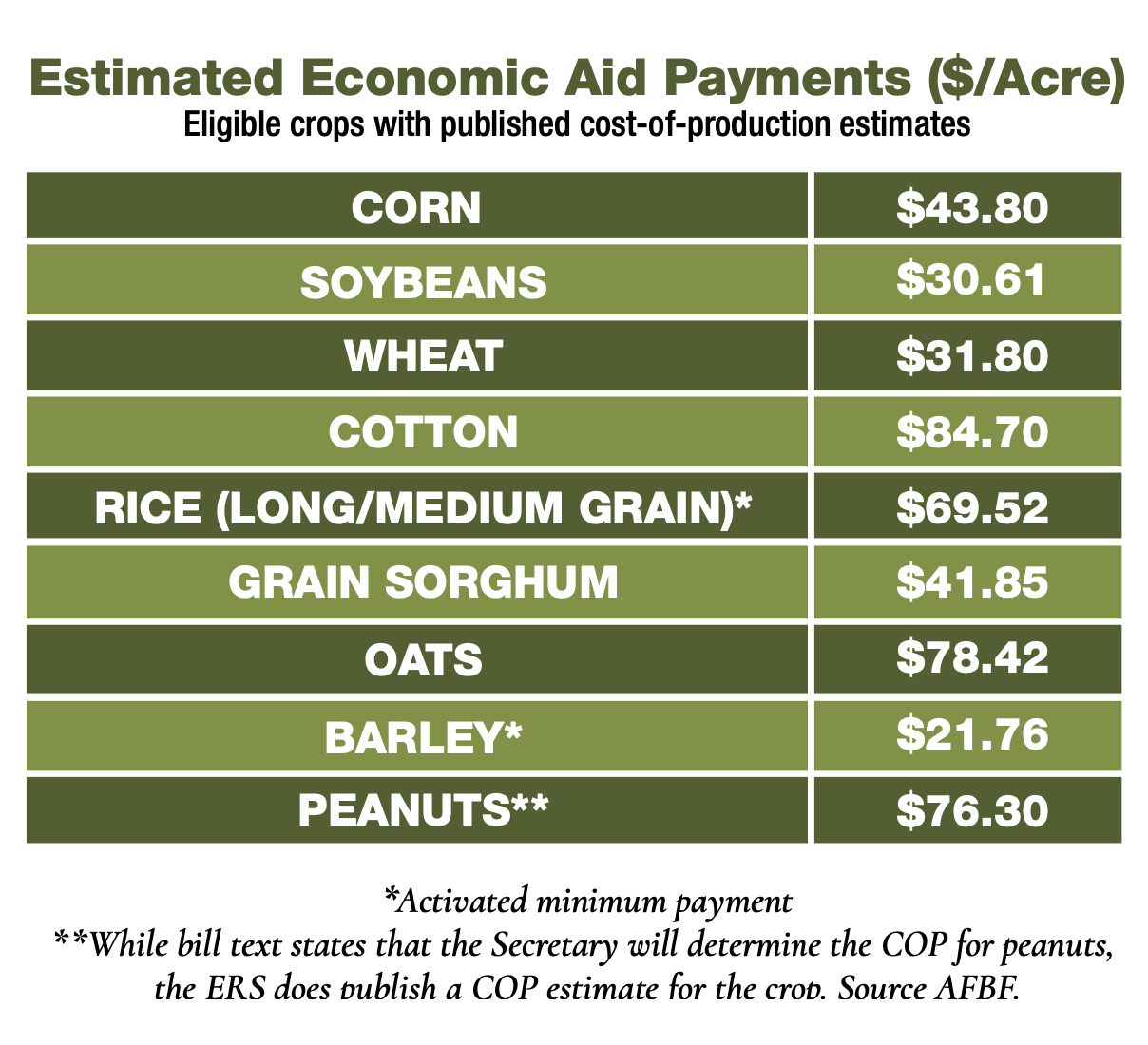

Payments per acre for each crop will be determined as the higher of the two formulas – primary payment or minimum payment.

The primary payment will be calculated by multiplying projected per-acre losses by a factor of 26%. For corn, soybeans, wheat, cotton, rice, sorghum, oats and barley, the payments are to be calculated using the USDA’s published national average cost-of-production forecasts.

For all other crops, USDA is to calculate a comparable total estimated cost of production. The projected revenue per acre will be calculated using projected 2024/25 market year average prices set in the Dec. 10 World Agricultural Supply & Demand Estimates and a 10-year average of the national average harvested yield per acre.

A minimum per-acre payment will be calculated by multiplying 8% of a crop’s statutory reference price by the national average payment yield. The payment yield is the yield used in calculating Price Loss Coverage (PLC) program payments.

The farmer will then be paid on all acres planted to eligible commodities for harvest, grazing, haying, silage or other similar purposes for the 2024 crop year. Additionally, farmers will be paid on 50% of all acreage prevented from planting during the 2024 crop year due to drought, flooding, other natural disasters or other conditions beyond the control of the farmer determined by the secretary of agriculture.

Economic aid will be capped at $125,000 for farmers and ranchers with less than 75% of their average gross income across tax years 2021, 2022 and 2023 derived from farming, ranching or forestry. The cap is $250,000 for farmers with 75% or more of their average gross income derived from farming, ranching and forestry.

The legal structure of the farm will determine the per-farm aid limit. If multiple farmers are part of a general partnership or joint venture, payment limitations are not imposed on the entity level but apply to each farmer individually.

Disaster Aid

.jpg)

Another ag-related provision in the American Relief Act is $21 billion in disaster aid. Dozens of natural disasters occurred in 2023 and 2024. Before estimates for Hurricanes Helene and Milton-related losses were included, AFBF estimated that uncovered disaster-related ag losses already exceeded $14.1 billion in 2023 and 2024.

Most of the $21 billion in ag disaster aid in the American Relief Act is to be distributed by USDA to cover necessary expenses related to the losses of revenue, quality or production for crops (milk, on-farm stored commodities, crops prevented from planting, and harvested adulterated wine grapes), trees, bushes and vines.

Qualifying losses include those caused by the following natural disasters occurring in calendar years 2023 and 2024: droughts, wildfires, hurricanes, floods, derechos, excessive heat, tornadoes, winter storms, freeze, smoke exposure and excessive moisture. Of the $21 billion, up to $2 billion will be used to cover livestock losses related to drought, wildfires and floods.

USDA may provide the disaster assistance through block grants to eligible states and territories, including assistance in the form of compensation to producers for timber, citrus, pecan and poultry (including infrastructure).

Producers insured under the Federal Crop Insurance Program or with coverage under the Noninsured Crop Disaster Assistance Program (NAP) for the applicable crop years are eligible to receive payments covering up to 90% of their disaster-related revenue losses, as determined by USDA. Payments are available for producers without crop insurance or NAP coverage but are capped at 70% of their disaster-related revenue losses as determined by USDA.

USDA has significant discretion to set program provisions, which will determine the assistance farmers receive.

Eligibility requirements and payment structures will follow the framework established in the Disaster Relief Supplemental Appropriations Act of 2022.

U.S. Agriculture Secretary Brooke Rollins has said the USDA is working to streamline delivery of the disaster funds.

State help

Gov. Brian Kemp announced Nov. 1 that the Georgia State Financing & Investment Commission approved redirecting $75 million to the Georgia Development Authority to provide disaster relief loans to farmers hit by Hurricane Helene. An additional $25 million was allocated for timber debris cleanup programs administered by the Georgia Forestry Commission in December.

The Georgia Department of Agriculture has worked with the development authority to get the ag loans up and running. Farmers in disaster counties or an adjacent county were eligible to apply for up to $500,000 at 2% fixed interest.

In January, Gov. Kemp and Georgia Commissioner of Agriculture Tyler Harper asked the Georgia legislature to appropriate more money for more loans, which state legislators voted to add to the state's Amended Fiscal Year 2025 budget. On March 6 Kemp signed the amended budget, which included an additional $185 million to be allocated for low-interest loans to repair damaged agricultural structures and grants for timber owners to help with the cleanup of fallen trees. The budget included an additional $25 million for Hurricane Helene relief efforts that will be administered by the One Georgia Authority.

Georgia legislators are also considering Kemp’s proposal to exempt ag federal disaster payments from state income tax, give a tax credit for the clean-up or replanting of trees damaged by Helene, and a sales tax exemption for materials used to repair buildings used to raise animals like poultry houses and livestock barns. As of March 11, the Georgia House had passed legislation to grant the tax breaks, and the legislation was making its way through the Georgia Senate.