Ag News

Congress extends farm bill through September 2025

Posted on Jan 14, 2025 at 10:18 AM

On Dec. 21, 2024, President Joe Biden signed into law the American Relief Act of 2025, providing fiscal year 2025 appropriations for the federal government though March 14, 2025, while funding disaster relief and economic assistance to farmers and extending the 2018 farm bill through September 2025.

“Farm Bureau thanks the House and the Senate for finding common ground and passing legislation that will keep the government open and help farmers who are struggling with natural disasters, high supply costs and out-of-reach interest rates,” AFBF President Zippy Duvall said. “For many farmers, the disaster relief provided through the CR will be the difference between planting for another year or going out of business.”

The bill passed the U.S. House by a 366-34 vote and the Senate by an 85-11 vote. Ten of Georgia’s 14 representatives and both of the state’s senators voted for passage.

Following is analysis from AFBF’s Market Intel:

The 2018 farm bill expired – for a second time – on Sept. 30, 2024. While the farm bill has been expired for nearly three months, the impacts of an expiration unfold slowly and unevenly across programs it supports. If an extension had not been passed, markets would have gone over the “Dairy Cliff” on Jan. 1, with USDA required to purchase dairy products at about twice current market prices, based on parity price formulas established in the 1930s using 1910-1914 commodity prices. Similarly high prices would have been offered for many crops in the 2025 crop year under so-called permanent law, which is suspended with every farm bill – and every farm bill extension.

While the farm bill extension gives Congress until Sept. 30, 2025, to pass a new farm bill, it did not fund numerous programs without baseline funding – so-called “orphan programs.” The first extension of the 2018 farm bill included $177 million for 19 of its 21 orphan programs for the 2024 fiscal year. The current extension includes no such funding. Unfunded programs range from the Feral Swine Eradication and Control Pilot Program to Emergency Citrus Disease Research.

Disaster Aid

The second pillar of agriculture-related provisions in the American Relief Act of 2025 is $21 billion in disaster aid. Dozens of natural disasters occurred in 2023 and 2024 with over $1 billion in economic impact. For agriculture, significant events across these years include extreme drought in the Gulf Coast; hurricanes Hilary, Idalia, Helene and Milton; and flooding in the Northeast and California. Before estimates for hurricanes Helene and Milton-related losses were included, Farm Bureau estimated that uncovered disaster-related agricultural losses had already exceeded $14.1 billion across 2023 and 2024 alone.

Most of the $21 billion in agriculture disaster aid in the American Relief Act of 2025 is to be distributed by USDA to cover necessary expenses related to the losses of revenue, quality or production for crops (including milk, on-farm stored commodities, crops prevented from planting, and harvested adulterated wine grapes), trees, bushes and vines. Qualifying losses include those caused by the following natural disasters occurring in calendar years 2023 and 2024: droughts, wildfires, hurricanes, floods, derechos, excessive heat, tornadoes, winter storms, freeze (including a polar vortex), smoke exposure and excessive moisture. Of the $21 billion, up to $2 billion will be used to cover livestock losses related to drought, wildfires and floods and $3 million is mandated to be used to carry out regular testing for molasses imports at port of entry.

USDA may provide the disaster assistance through block grants to eligible states and territories, including assistance in the form of compensation to producers for timber (including non-federal forest landowners), citrus, pecan and poultry (including infrastructure), and agricultural producers who have suffered losses due to the failure of Mexico to deliver water to the United States in accordance with the 1944 Water Treaty.

Producers who have insurance under the Federal Crop Insurance Program or coverage under the Noninsured Crop Disaster Assistance Program (NAP) for the applicable crop year are eligible to receive payments covering up to 90% of their disaster-related revenue losses, as determined by USDA. For producers without crop insurance or NAP coverage, payments are available but are capped at 70% of their disaster-related revenue losses as determined by USDA. If uninsured losses are determined to represent only a de minimis (insignificant) portion of a producer's overall revenue losses, USDA may allow payments covering up to 90% of total losses. However, USDA has significant discretion in defining terms like “de minimis” and setting program provisions, which will ultimately determine the amount of assistance farmers receive. Other provisions, such as county-level drought triggers, administrative cost caps, expanded reporting obligations and payment rules for specialty categories, will follow the framework established in the Disaster Relief Supplemental Appropriations Act of 2022 to ensure consistency and clarity in program implementation.

Economic Aid

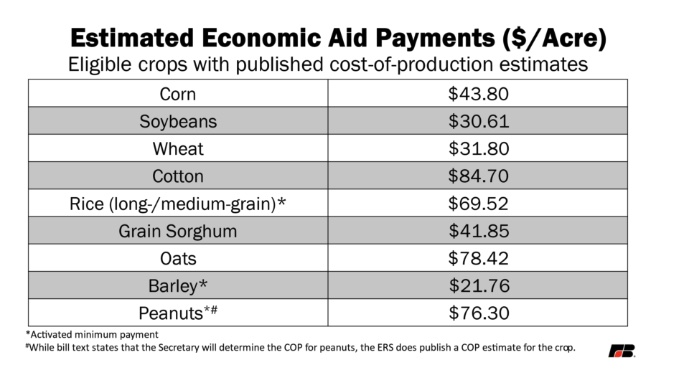

Of the bill’s $31 billion in direct payments for farmers and ranchers, $10 billion is specifically for economic aid in response to the perilous financial situation in farm country, particularly for row crop farmers. According to bill text, the $10 billion must be distributed within 90 days of enactment through a one-time economic assistance payment for producers of eligible commodities in the 2024 crop year. Eligible commodities include all those covered by Title I of the farm bill, excluding temperate rice japonica.

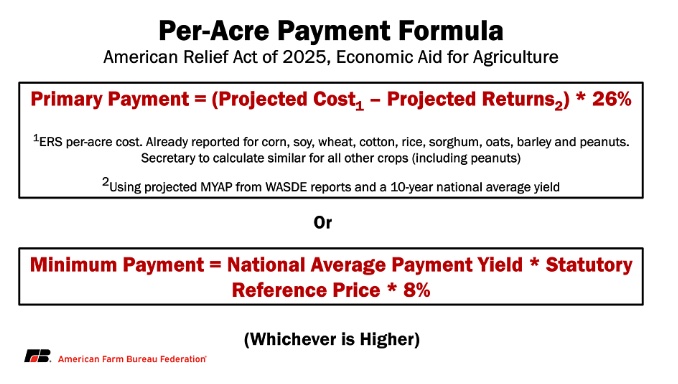

Payments per acre for each crop will be determined as the higher of the two formulas – primary payment or minimum payment.

The primary payment will be calculated by multiplying projected per-acre losses by a factor of 26%. For corn, soybeans, wheat, cotton, rice, sorghum, oats and barley, the payments are to be calculated using the USDA-Economic Research Service’s published national average cost-of-production forecasts. For all other crops, USDA is to calculate a comparable total estimated cost-of-production. The projected revenue per acre will be calculated using projected 2024/25 market year average prices set in the Dec. 10 World Agricultural Supply and Demand Estimates (WASDE) and a 10-year average of the national average harvested yield per acre.

A minimum per-acre payment will be calculated by multiplying 8% of a crop’s statutory reference price by the national average payment yield. The payment yield is the yield used in calculating Price Loss Coverage (PLC) program payments.

The farmer will then be paid on all acres planted to eligible commodities for harvest, grazing, haying, silage or other similar purposes for the 2024 crop year. Additionally, farmers will be paid on 50% of all acreage that was prevented from planting during the 2024 crop year due to drought, flooding, other natural disaster or other conditions beyond the control of the farmer as determined by the secretary of agriculture.

For commodity per-acre payment estimates provided by AFBF, click here.

Economic aid will be capped at $125,000 for farmers and ranchers with less than 75% of their average gross income across tax years 2021, 2022 and 2023 derived from farming, ranching or forestry. The cap is increased to $250,000 for farmers with 75% or more of their average gross income derived from farming, ranching and forestry. There is no traditional adjusted gross income maximum to receive aid, and economic aid payment limitations are unrelated to any other program’s payment limits. As is typical with ARC/PLC payments and other forms of agricultural direct payments, the legal structure of the farm will determine the per-farm aid limit. If multiple farmers are part of a general partnership or joint venture, payment limitations are not imposed on the entity level but apply to each farmer individually.

Additional Miscellaneous Agriculture-Related Funding

A hodgepodge of other disaster funding to be administered by USDA totals $2.5 billion, including several funding items closely aligned to a November White House request for emergency funding for USDA. Additional USDA funding includes:

• $7.5 million for the Office of the Inspector General for oversight of projects and activities carried out by funds given to USDA in the continuing resolution;

• $42.5 million for Agricultural Research Service’s building and facilities;

• $356.535 million for Farm Service Agency’s Emergency Forest Restoration Program;

• $828 million for the Farm Service Agency’s Emergency Conservation Program;

• $920 million for the Natural Resources Conservation Service’s Emergency Watershed Protection Program;

• $362.5 million for the Rural Development Program’s Rural Development Disaster Assistance Fund; and

• $25 million for the Food and Nutrition Service’s Commodity Assistance Program to support The Emergency Food Assistance Program (TEFAP) for infrastructure needs related to the consequences of major disaster declarations from 2023 and 2024.

The American Relief Act of 2025 will provide much-needed relief to farmers and ranchers across the country. A total of $31 billion of economic and disaster aid for farmers and an extension of the 2018 farm bill has certainly saved farms. However, an updated farm bill with a functioning safety net would have made much of this ad hoc aid unnecessary. The suspension of funding for the orphan programs also leaves a hole for some important priorities for agriculture. A new farm bill in 2025 could plug these holes and prevent the need for ad hoc economic aid in future years.

For the entire Market Intel analysis on the farm provisions of the American Relief Act of 2025, including commodity per-acre payment estimates, click here.

- Categories:

- Tags: