Agriculture + Lifestyle

Farmers hesitant to dive into carbon markets

Posted on February 26, 2023 7:00 PM

By Jay Stone, Georgia Farm Bureau

There is a strong case that agricultural soil is a viable tool for storing, or sequestering, carbon. It can be done. But it seems farmers aren’t sold on the idea of entering carbon markets to generate income.

A pair of Purdue University professors, Dr. Shalamar Armstrong and Dr. Nathanael Thompson, presented information via video on field crops’ relationship with U.S. carbon markets during the 2023 UGA Corn Short Course, held Jan. 17 in Tifton.

Armstrong, an associate professor in the Purdue Department of Agronomy, reviewed how carbon sequestration works and offered research showing the potential carbon storage yield in the United States.

Soil & crops essential to markets

There are three primary components in the short-term global carbon cycle: Pools, which have the capacity to store, accumulate or release carbon; Sinks, which absorb more carbon from the atmosphere than they release; and Sources, which are natural or artificial producers of carbon or carbon-based compounds.

Soils are one of the main pools, and when farmers use reduced tillage or double-cropping, soils can also be sinks, Armstrong said. Reducing tillage leaves carbon in the soil, but tillage disturbs the soil, prompting microbial organisms to metabolize carbon in the soil and release carbon dioxide into the atmosphere.

Carbon is captured through photosynthesis, so increasing the time plants are photosynthesizing increases the amount of carbon captured.

“If you’re growing corn and then you come back and you grow rye behind it, you’ve just moved from a single-cropping carbon system to a double-cropping carbon system,” Armstrong said. “Two different crops, two different plants, two different sets of roots in the ground, multiple periods of time, causes greater photosynthetic capture of carbon. Then the potential increase in soil organic carbon, the conversion from those plants into some semipermanent pool of carbon, that generates what we call a carbon credit.”

article continues below

Cover crops like this rye can capture carbon. / Photo by Jay Stone

How markets work

Nationally, U.S. agriculture has the potential to store as much as 187 million tons of carbon, Armstrong’s research shows.

Carbon credits can be bought and sold. A company can buy a carbon credit from the government, allowing that company to generate defined quantities of carbon dioxide gasses. Or, the company can buy carbon offsets from other non-governmental entities.

A farmer who is generating carbon credits can sell them as offsets to an entity looking to reduce its carbon footprint.

article continues below

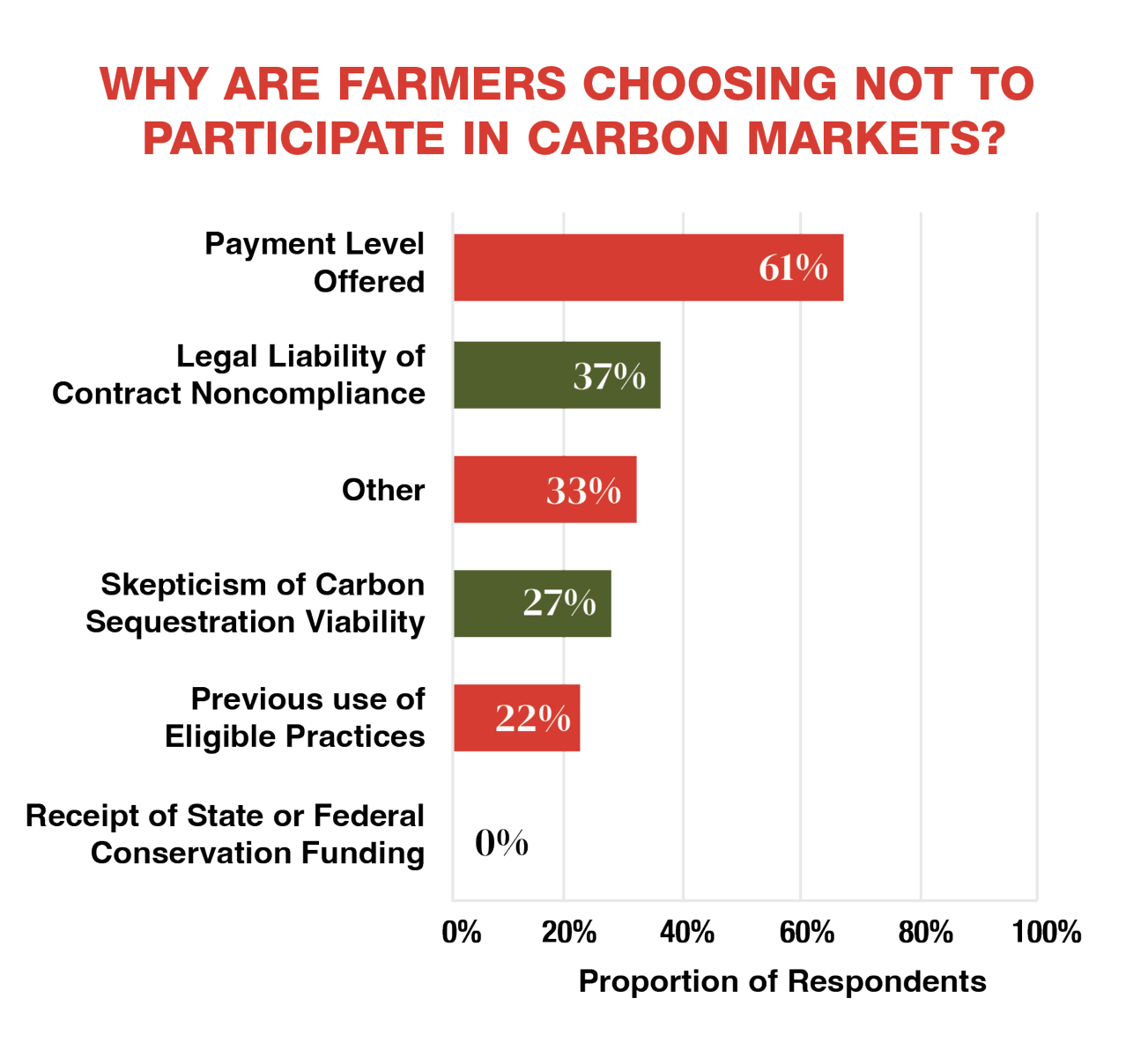

Source: Purdue University-CME Group Ag Economy Barometer, 2021 Surveys

Why are farmers hesitant?

Thompson, an associate professor of agricultural economics at Purdue, said farmers have been slow to enter the carbon markets. He cited data from the Purdue University/CME Group Ag Economy Barometer, a survey of 400 farmers about their sentiments regarding the farm economy.

Thompson noted the survey pool is generally representative of U.S. agriculture, and it shows that between February 2021 and August 2022, less than 9% of respondents had discussions with companies about receiving payments for capturing carbon. Less than 1.5% entered into contracts to sell their carbon as offsets.

“These markets are in their infancy,” Thompson said. “There are a lot of unknowns, a lot of details that need to be figured out.”

In large part, farmers have been slow to enter the carbon market because the money being offered falls short of offsetting the cost of adopting carbon-capturing practices. Current prices, Thompson said, range between $10 and $20 per metric ton (2,205 pounds).

The cost to convert from conventional tillage to conservation tillage is about $40 per acre. Thompson said if a farmer is capturing 0.5 metric tons per acre, that farmer would have to sell at a price of $80 per acre to cover the cost of conversion.

“It all relates to economics in terms of cost vs. benefits,” Thompson said. “There’s quite a bit of work left to be done on the price side.”