test-blog

Economic woes impact Georgia agriculture

Posted on November 21, 2022 7:00 PM

By Jennifer Whittaker, Georgia Farm Bureau

Georgia agriculture and the state’s rural communities are still feeling the effects of the COVID-19 pandemic, which has led to supply chain issues, rising inflation and interest rates, along with trade wars initiated in 2018.

“We’ve seen in the past two years that Georgia agriculture and our rural economies are vulnerable to the economic shocks we’ve experienced set off by the pandemic,” said Dr. Gupi Munisamy, UGA College of Agriculture & Environmental Sciences (CAES) agricultural marketing professor. “We need to find ways to get our people through these crises and to stabilize the water. Rural economies need innovation and unique approaches to prosperity.”

Munisamy spoke at the Joint Agriculture Committee Chairmen Ag Issues Summit Aug. 30 at the Georgia National Fairgrounds & Agricenter.

The last three Ag Snapshots reports, prepared by the UGA Center for Agribusiness & Economic Development, verify the impact.

In 2018, the farm gate value (FGV) of all food and fiber produced in Georgia was $13.79 billion. In 2019, the FGV of all food and fiber produced in Georgia was about $13 billion. The 2022 Ag Snapshots shows the FGV of all food and fiber production in Georgia was $12.2 billion. The 2023 Ag Snapshots will report the value of ag to Georgia’s economy in 2021 and 2022 values will be reported in 2024.

“Our ag economy is struggling. Farmers always worry about the weather and this year is no exception,” said Georgia House Agriculture Committee Chairman Rep. Robert Dickey, who produces peaches, pecans and timber. “We’re facing rising [input] prices. I paid double for fertilizer and our packaging costs are through the roof. There’s just a lot of challenges we face every day.”

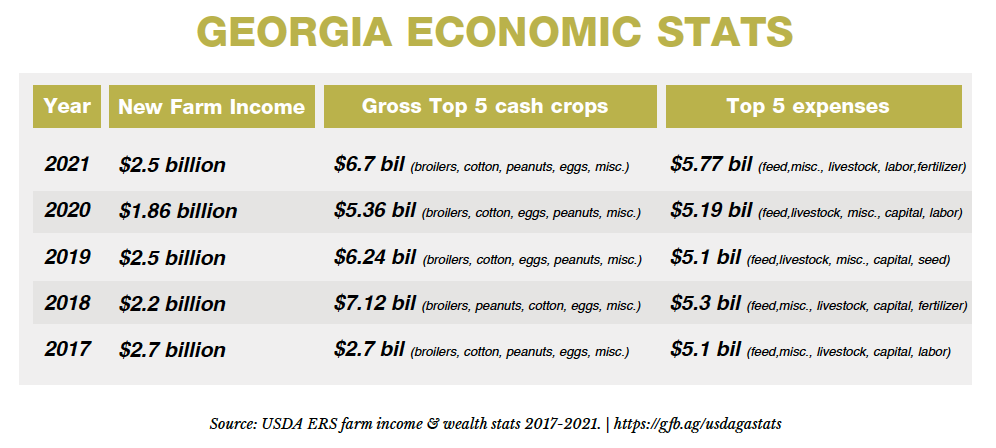

Munisamy offered some hope, saying, “Farm income patterns show progress after steep declines.”

While crude oil prices rose from $60 and $70 a barrel in February up to $100 per barrel this year, prices are expected to drop back to the $60 to $70 per barrel range by the end of the year, Munisamy said. Projections for broiler, cotton and peanut producers looks good he said.

“Long-term projections for broiler producers look great as there will be a demand for meat protein in Southeast Asia as their population grows,” Munisamy said, while acknowledging higher feed prices producers are experiencing due to drought conditions in other parts of the country and the threat highly pathogenic avian flu poses to producers.

He said drought in the western U.S. is driving up cotton prices and the forecast is stable for peanut prices.

“Fruits, vegetables and nuts will remain a near and long-term challenge as imports of fruits and veggies will continue to increase over the next ten years,” Munisamy said.

He said the USDA predicts net farm income for U.S. farmers will be down for 2022 compared to 2021 without USDA Market Facilitation Program and Coronavirus Food Assistance Program payments.